WHAT IS SUPPLY AND DEMAND?

In the following lessons you will learn how to trade using SUPPLY AND DEMAND IOF HARM METHODOLOGY. Capitalism rules the markets in much the same way as the law of gravity rules our planet. Buyers and sellers are in a constant and never-ending battle trying to agree on a fair price on the traded product. The only reason why a price moves in any, and all markets, is because of the imbalance in supply and demand. The greater the imbalance, the greater the move in price.

WHY DO IMBALANCES OCCUR?

• The currency market, the financial world in general is dominated and ruled by big investors, institutions, central banks and professional trades. They have the ability and capacity to move and change the markets with thousands of orders- These orders create the so-called supply and demand imbalances.

• Daily news occurs and affects the world's economies

• Positive news usually increases demand, and reduces supply, leading to higher prices

• Negative news usually decreases demand, and results in an increased supply

• The retailer and small investor ends up becoming the bait, the liquidity the professional traders need to fill many of their orders. They can't sell if there are no buyers interested Every trader/institution has a different perception of fair price and future value. Supply is simply the amount available, while demand is the amount that is wanted. Supply is the amount available at a particular price, while demand is the amount that is wanted or desired at a specific price.

• As prices increase, a seller’s willingness to sell products will also increase.

• The opposite of this shows that as prices increase, we see demand reduces. Buyers will demand more when prices are lower.

REAL LIFE EXAMPLE.

Let’s imagine that your partner asks you to purchase some meat for dinner. You go to the market and see the price of the steak you normally buy has almost doubled! It’s now going to cost you twice as much to enjoy your barbecue; you quickly begin to think how valuable that steak might be. You begin to look at alternatives, such as hamburgers or a chicken; replacement products with which you can get a similar result at a far lower cost. While you may decide to pay the increased price of that steak, you have to think of the market dynamics at work. Not every steak buyer would be interested in doing this; many would opt for replacement products because they could not afford the new higher price. This is a living example of a supply and demand SD range. As the steak price increases, demand for steak decreases. The next week you go to the supermarket, and see that steak is half of what you normally pay for it; it's 80% off of last week’s price. Now you will think differently to the previous week. You will be thinking that you can buy more while the price is cheap. Other customers are buying while price is cheap, you realize that if you don’t act fast, all of the discounted meat will be gone before you buy any! This is demand at work again. As the price of steak lowered, demand increased, not only for you, but the market in general. This example is very similar to what we see on the currency markets. The Forex market is the largest in the world, $5tr is traded every day, and the reason for this is the heavy demand behind the traded assets.

Currencies are the basis for the world’s economy. Whenever one economy wants to trade with another economy (provided different currencies are used) a Forex exchange will be required. Unlike markets that are traded through an exchange, each Forex broker is essentially creating a market. More or less, the charts will look the same, but individual bars can be different and price patterns in particular can vary a little from broker to broker. Ultimately, the various markets created by the brokers will, to some extent, be arbitraged (the simultaneous buying and selling of indices, currency, or commodities in different markets or in derivative forms in order to take advantage of differing prices for the same asset.) so they stay close to each other. In the end you have to trade what you see on your charts and ignore everything else. What we perceive as the personality of a pair is just manipulation of a pair. Some instruments have lower liquidity (some Forex cross pairs and exotics), zones are overshot and then they work great. That is not the picture of "this instrument does not respect supply and demand” that is the picture of "this instrument is being manipulated, bear traps, and bull traps". Remember that Forex is the biggest market in the world, it's traded by professionals and not by retailers. A hunter has all sort of traps to capture its prey, so do the big institutions. We are trying to combat professional hunters, as retailers we are their prey.

SUPPLY, DEMAND AND THE MARKETS, HAVE MEMORY. How many times have you seen a market retrace back to a level where a recent major move started from, only to respect that level almost exactly before making another strong directional move? It happens often enough to be something that you need to understand, and know how to make correct use of them, because these scenarios can often yield very high-probability and high reward to risk trades. It’s important to note that the trade setups at IOF HARM METHODOLOGY are not a ‘perfect science’, but there are occurrences in the market that are critical to understand, and a tool to have at your disposal when you’re analyzing charts.

WHAT ARE THE LOOKS OF AN IMBALANCE?

The goal of any small or big investor is to have the capacity to identify where and when the market is most likely to turn and if it does, where it could be heading to. This is not the only way to attain low risk and high probability trading opportunities. As you will see in further lessons, markets usually turn or reverse at price areas where supply and demand are out of balance, that is to say, at supply and demand imbalances. The stronger these imbalances are the higher the likelihood the turn in price. If this is so, how can we identify these levels on a chart? Why is it that big institutions usually make so much money and are correct most of the time and at the same time, retail traders and small investors are usually wrong most of the time and lose most of their money? The typical small trader will try to find charts where there is a lot of activity, that is, there are lots of candlesticks trading at a certain area. They will think, well, they've been told that the more activity you see, the more volume there is, the more probable price is going to turn at that price level. However, what happens is exactly the opposite. Price will turn or reverse at price areas where there is a very important imbalance between supply and demand. What we will see at these imbalances will be very little trading activity. Most of the activity is mostly on one side of the market. We will deal with this in further lessons when scoring imbalances on the amount of trading activity there is at a potential imbalance. Well, it's not many candles at a price area like classic support and resistance and other technical analysis suggests, it’s actually very few candles you need to see. These price areas where there is little activity and a sudden strong impulse is what we are interested in because all the potential activity is mostly on one side of the market, the big investor.

These investors will leave a footprint when they execute their transactions, we are going to learn how to locate these footprints left on the charts and trade with them, not against them. We are looking for a significant quantity of unfilled orders, these unfilled orders leave a trace or a footprint on a price chart that can be easily located if you have trained your eyes and brains long enough. How does it look like on a price chart?

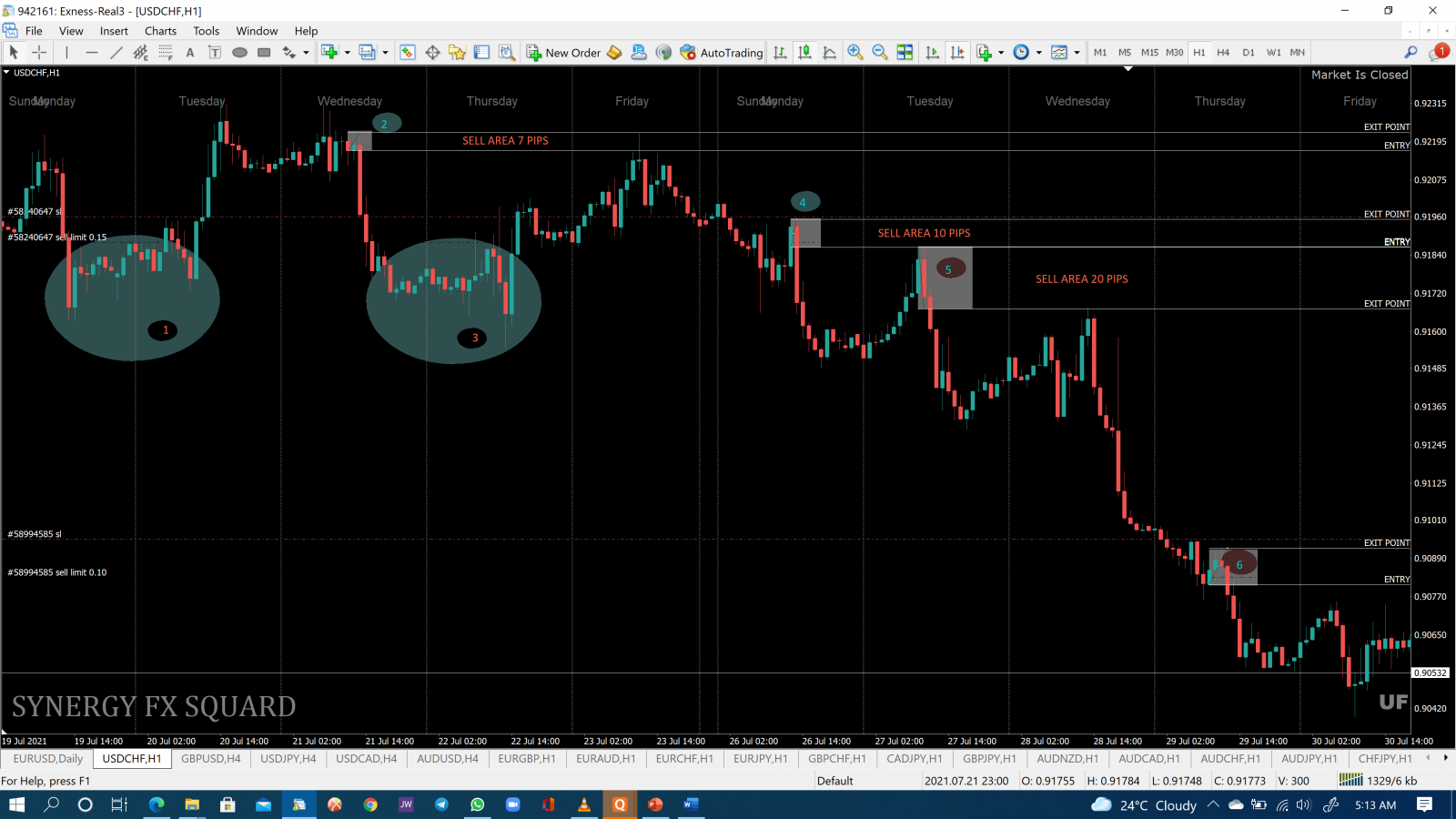

Below is EURUSD Daily chart for July 2021.

• The areas within the ellipse at [1] and [3] with a lot of candles is what traditional technical analysis would tag as "support and resistance levels". Price areas with lot of trading activity and potentially a lot of volume.

• When price reaches these level [1], it can't push through it, it stalls and stay there for a bit because there is some demand at that level. However, with so much trading activity and congestion at that price level, we can't say the imbalance is strong enough.

• If we pay closer attention to price levels [4], and [5], there is not too much activity, the typical investor would probably ignore it and consider it not to be a good price level to sell.

• However, that is exactly what we are looking for, a very strong imbalance with not too much activity at the origin of the move and a strong move away, these are the kind of footprints big investors are leaving behind.

• Having a strong or very strong imbalance does not mean that price is always going to react positively as expected. In such cases, It is not respected even though the strength of that level was important and there was not too much activity. It stalled there for two days and then it was eliminated This is exactly what you are going to learn in the lessons. You will be guided step by step how to find these footprints left by big investors and trade with them, not against them.

TRADING IS NOT GAMBLING. GAMBLING IS NOT TRADING. There are aspects of trading and gambling that relate with each other, and there are some important things we can learn from expert gamblers. Why are we interested in learning how to trade supply and demand? Why do we have to make a trade plan? Why do we follow a set of rules to trade?

The answer to all of this is "to have an edge". To be able to identify the buy and sell signals in the market and execute the trades systematically to enable consistent results in our trading. To be more precise 'having an edge" means having probability on our side. Notice the word "probability". It's very important to understand that no edge can give us guaranteed success; it can help only with probability. The trader's edge is to think in probabilities and to understand this, it is best to look at the gambling industry. The gambling industry is based on probability, with an edge in favour of the operators. The word probability suggests inconsistency, but it can produce consistent results over a large sample of trades if the edge is good enough, applied consistently.

YOUR EXCUSES ARE NOTHING MORE THAN YOUR FEARS COMING TO GET YOU.

In order to succeed in the trading business, you need a SOUND METHODOLOGY, COMMON SENSE, DISCIPLINE and a ROCK-SOLID UNDERSTANDING on how to approach the market for a long-term success.

To Start, CLick this Link below...

HURRY NOW WHILE THE PROMOTION LASTS